fulton county illinois property tax due dates 2021

2022 DEVNET Inc. FULTON COUNTY BOARD OF COMMISSIONERS.

Illinois Department Of Children And Family Services

IF YOU OWN AND LIVE IN A HOME IN FULTON COUNTY HOMESTEAD EXEMPTIONS MAY HELP REDUCE YOUR PROPERTY TAXES.

. Founded in 1836 today Will County is a major hub for roads rail and natural gas pipelines. Ford County Treasurer. Pay property tax online in the county of fulton illinois using this service.

First Installment due date is July 2nd 2021. Forms Documents EXEMPT PROPERTY QUESTIONNAIRE - REVISED 2017 Exemption Questionnaire. Taxes paid within 10 days of the due date are subject to 5 penalty.

Illinois is ranked 893rd of the 3143 counties in the United States in order of the median amount of property taxes collected. 2021 re tax due dates. Real estate taxes are generally due on February 5 for the first half billing and July 20 for the second half billing.

Payments and correspondence may always be mailed directly to the DuPage County Treasurers Office at 421 N. The 2020 payable 2021 tax bills for Ford County will be mailed May 28th 2021. The Fulton County Treasurer and Tax Collectors Office is part of the Fulton County Finance Department that encompasses all financial.

The Treasurers Office accepts Online Payments for the Following ONLY. The Illinois sales tax rate is currently. Houses 5 days ago TAX NOTICE.

Lake County Property Tax Appeal Deadlines Due Dates 2021. The deadline to pay property taxes is approaching. DuPage County Collector PO.

If you have an escrow account for taxes through your mortgage company your tax bill. The 1st half 2021 Real Estate taxes are due by February 7 th 2022. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax.

The median property tax in illinois is 350700 per year for a home worth the median value of 20220000. The phone number should be listed in your local phone book under Government County Assessors Office or by searching online. In most counties property taxes are paid in two installments usually June 1 and September 1.

Taxpayers who do not pay property taxes by the due date receive a penalty. Property Taxes The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. Property tax payments are made to your county treasurer.

Contact your county treasurer for payment due dates. The 2nd half 2021 Real Estate taxes will be due on July 20 th 2022. The Fulton sales tax rate is.

FULTON COUNTY HOMESTEAD EXEMPTION WWWFULTONASSESSORORG GUIDE FULTON COUNTY 2021. The County sales tax rate is. The due date and delinquent date depends on when the bill is mailed.

Fulton County Board of Assessors. Welcome to Ford County Illinois. City of Gloversville County Property Tax beginning January 1.

Box 4203 Carol Stream IL 60197-4203. Cook County Il Property Tax Calculator Smartasset Douglas st suite 503 freeport il 61032. The median property tax in Fulton County Illinois is 1406 per year for a home worth the median value of 79000.

Fulton County collects on average 178 of a propertys assessed fair market value as property tax. County Farm Road Wheaton IL 60187. APPLY ONLINE AT WWWFULTONASSESSORORG CALL US AT 404-612-6440 X 4.

Taxes paid after 10 days are subject to a 10 penalty. The median property tax in Fulton County Illinois is 1406 per year for a home worth the median value of 79000. This page is your source for all of your property tax questions.

Payments can be made through major credit cards eBilling eChecks Apple Pay and Google Pay. You should check with your county tax commissioners office for verification. Normal collection will resume on may 1.

By now all Fulton County property owners should have received tax statements by mail. FULTON COUNTY 2021 HOMESTEAD EXEMPTION GUIDE. Each advertisement shows the owners name a description of the property to be sold and the amount of the tax due OCGA.

When are property taxes due in fulton county oh. This is the total of state county and city sales tax rates. Lake County collects the highest property tax in Illinois levying an average of 628500 219 of median home value yearly in property taxes while Hardin County has the lowest property tax in the state collecting an average tax of 44700 071 of.

No payments are accepted during april. The 1st half 2021 Real Estate taxes are due by February 7 th 2022Taxes paid within 10 days of the due date are subject to 5 penaltyTaxes paid after 10 days are subject to a 10 penalty. Tuesday March 2 2021.

Created with Raphaël 212. The county seat of Will County is Joliet. View Form PT-283A Application for Current Use Assessment of Bona Fide Agricultural Property Application for Current Use Assessment Of Agricultural property PT-283A.

The initial Form PTAX-327 Application for Natural Disaster Homestead Exemption must be filed with the Chief County Assessment Office no later than July 1 of the first taxable year after the residential structure is rebuilt or the filing date set by your county. Will County is located in the northern part of Illinois and is one of the fastest-growing counties in the United States. County and county school ad valorem taxes are collected by the county tax commissioner.

The exact property tax levied depends on the county in Illinois the property is located in. The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax. The Fulton County Treasurers Office located in Lewistown Illinois is responsible for financial transactions including issuing Fulton County tax bills collecting personal and real property tax payments.

Even though the official due date for ad valorem tax payment is December 20th the local governing authority may adopt a resolution changing the official due date for tax payment to December 1st or November 15th or may implement installment billing with multiple due dates. The minimum combined 2022 sales tax rate for Fulton Illinois is. Please contact the office if you.

Tax Notice Fulton County OH - Official Website. Did South Dakota v. Property Tax Page 141 Pryor Street SW Atlanta GA 30303.

Created with Raphaël 212. Real estate taxes are mailed out semi-annually and are always one year in arrears. The 2nd half 2021 Real Estate taxes will be due on July 20 th 2022.

2022 Property Tax Calendar. Beginning May 2 2022 through September 30 2022 payments may also be mailed to. HOMESTEAD EXEMPTION DEADLINE - APRIL 1 2021.

Please contact the office if you dont receive a bill. Wayfair Inc affect Illinois. If the due date falls on a holiday or a weekend the due date will be extended to the next working day.

Illinois Economic Recovery From Covid Threatened Moody S Report Says Crain S Chicago Business

4th Of July Fireworks 2021 What S Legal What S Not In Illinois Chicago Il Patch

Illinois Eviction Laws The Process Timeline In 2022

Illinois Used Car Taxes And Fees

Terms Fulton County Treasurer Il Online Payments

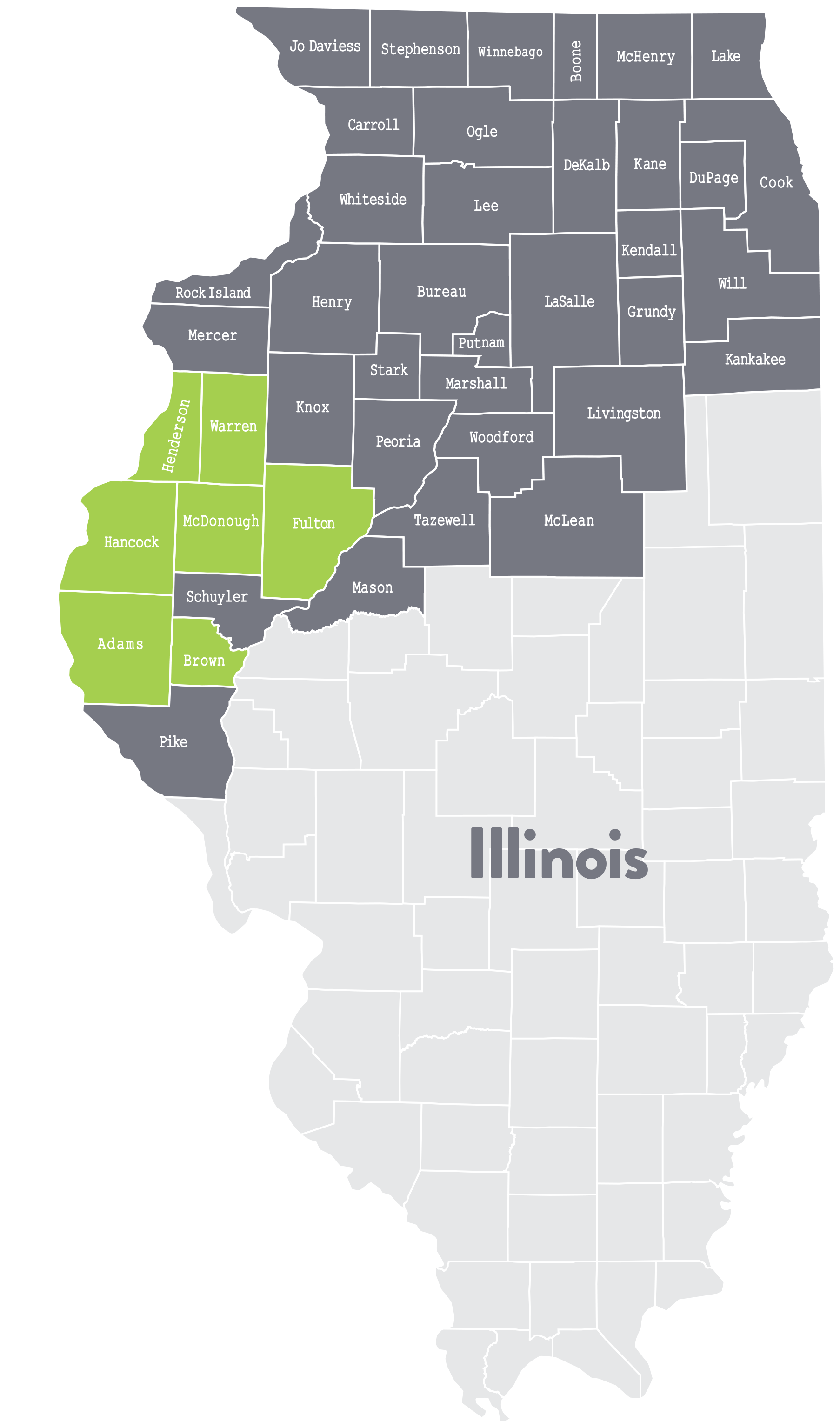

Land Values Accelerate Across West Central Illinois

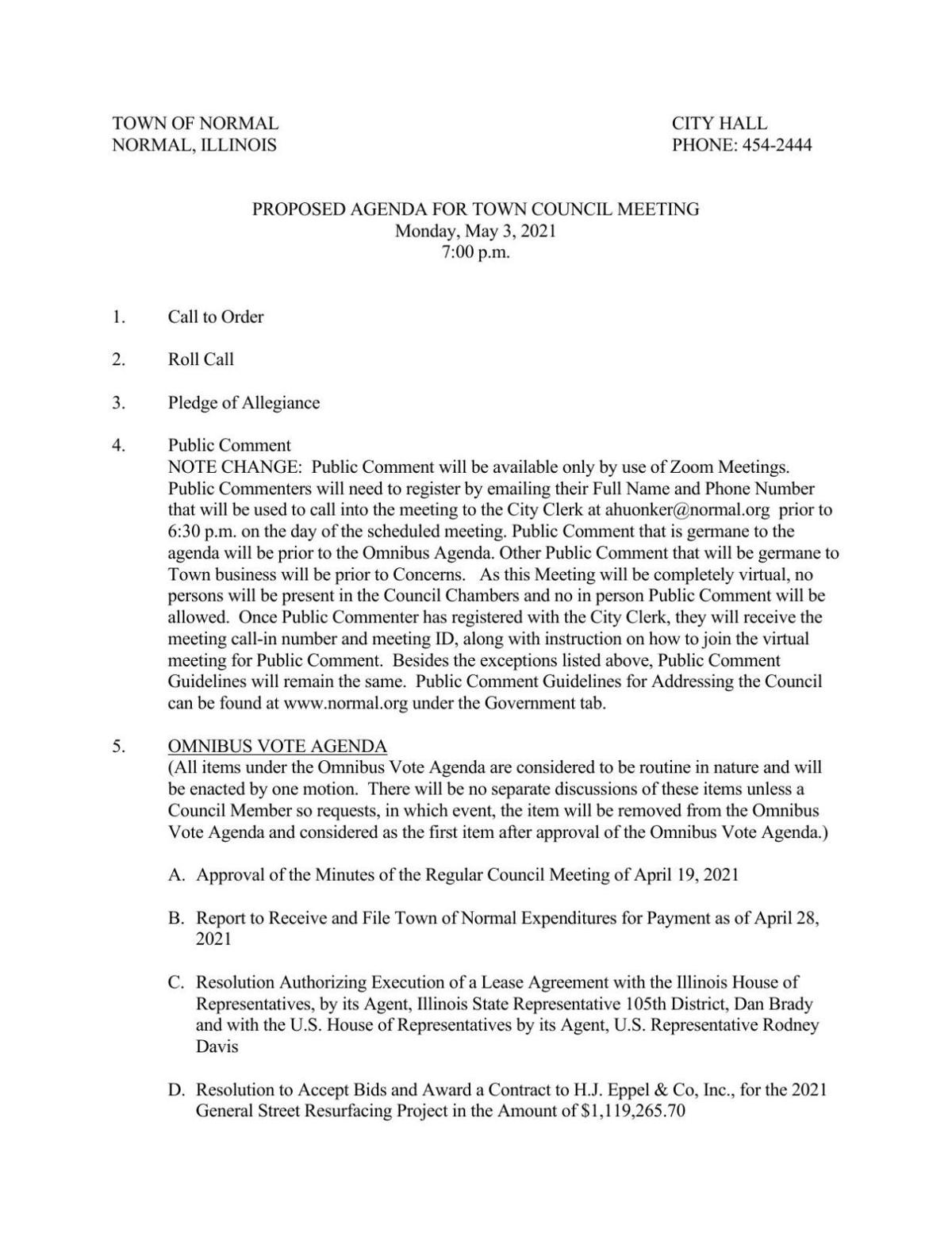

Normal To Abate Rivian Property Taxes Ok Zoning Requests Politics Pantagraph Com

Central Illinois Fire Society Posts Facebook

Illinois Property Tax Exemptions What S Available Credit Karma Tax

Representative Sean Casten Representing The 6th District Of Illinois